Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 8E

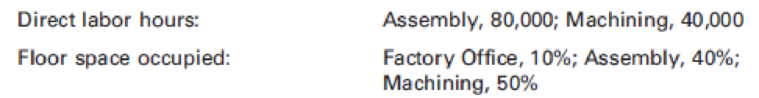

A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining.

The following data have been estimated for next year’s operations:

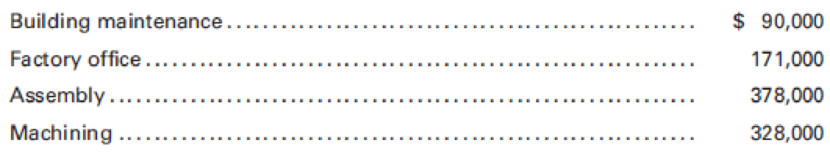

The direct charges identified with each of the departments are as follows:

The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while

- 1. Distribute the service department costs, using the direct method.

- 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Joe's Tire Company has two support departments, Personnel and Maintenance. The Maintenance Department costs

of $80,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $20,000

are allocated based on the number of employees. Costs of Departments A and B are $40,000 and $60,000,

respectively. Data on standard service hours and number of employees are as follows. How much of the cost of the

Personnel Department is allocated to Department B using the direct method? Round to the nearest dollar.

Personnel

Department

200

Standard service

hours used

Number of

employees

O A. $8,000

O B. $60,000

O C. $12,632

D. $5,000

E. $15,000

Maintenance

Department

200

10

20

CO

Production

Department A

240

40

Production

Department B

160

120

Using the direct method, compute for the factory overhead rate of the D

department if it apply overhead based on direct labor hours and budgeted direct

labor hours for the period total to 75,000 hours.

Sylvie Corporation has three production departments: K, D, and C. It also has two service

departments: Administration and Personnel. Administration costs are allocated based on value of

assets employed, and Personnel costs are allocated based on number of employees. Assume that

Administration provides more service to the other departments than does the Personnel

Department.

Department

Administration

Direct Costs Employees Asset Value

900,000

1,200,000

600,000

300,000

1,600,000

1,800,000

700,000

1,400,000

400,000

500,000

50

Personnel

20

K

30

D

10

C

20

University Printers has two service departments (Maintenance and Personnel) and two operating departments (Printing and

Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and

personnel costs on the basis of labor-hours worked by the employees in each.

The following data appear in the company records for the current period:

Maintenance

Personnel

Developing

Printing

1,400

Machine-hours

1,400

4,200

Labor-hours

800

800

3,200

Department 'direct costs

$2,400

$12,400

$13,400

$10,700

Required:

Use the direct method to allocate these service department costs to the operating departments. (Negative amounts should be

indicated by a minus sign. Do not round intermediate calculations.)

Answer is not complete.

Maintenance

Personnel

Printing

Developing

Service department costs

$2$

2,400 $

12,400 O

Maintenance allocation

(2,400) O

600

1,800 V

Personnel allocation

2,480

9,920

Total costs allocated

$

2$

12,400

$ 3,080

$24

11,720

Chapter 4 Solutions

Principles of Cost Accounting

Ch. 4 - What are factory overhead expenses, and what...Ch. 4 - What are three categories of factory overhead...Ch. 4 - What are the distinguishing characteristics of...Ch. 4 - When a products cost is composed of fixed and...Ch. 4 - What effect does a change in volume have on total...Ch. 4 - Distinguish between a step-variable cost and a...Ch. 4 - What is the basic premise underlying the high-low...Ch. 4 - What are the advantages and disadvantages of the...Ch. 4 - Differentiate between an independent variable and...Ch. 4 - Prob. 10Q

Ch. 4 - What is a flexible budget, and how can management...Ch. 4 - How does accounting for factory overhead differ in...Ch. 4 - What is the function and use of each of the two...Ch. 4 - What are two types of departments found in a...Ch. 4 - What are the two most frequently used methods of...Ch. 4 - When using the sequential distribution method of...Ch. 4 - When using the sequential distribution method of...Ch. 4 - Is it possible to close the total factory overhead...Ch. 4 - What are the shortcomings of waiting until the...Ch. 4 - What are the two types of budget data needed to...Ch. 4 - Prob. 21QCh. 4 - What factory operating conditions and data are...Ch. 4 - Prob. 23QCh. 4 - How does activity-based costing differ from...Ch. 4 - What steps must a company take to successfully...Ch. 4 - What is the relationship between activity-based...Ch. 4 - Prob. 27QCh. 4 - Prob. 28QCh. 4 - If the factory overhead control account has a...Ch. 4 - Prob. 30QCh. 4 - Classify each of the following items of factory...Ch. 4 - Ames Automotive Company has accumulated the...Ch. 4 - Prob. 3ECh. 4 - Using the data in E4-2 and spreadsheet software,...Ch. 4 - El Paso Products Company has accumulated the...Ch. 4 - Computing unit costs at different levels of...Ch. 4 - Identifying basis for distribution of service...Ch. 4 - A manufacturing company has two service and two...Ch. 4 - A manufacturing company has two service and two...Ch. 4 - Compute the total job cost for each of the...Ch. 4 - Classify each of the following items of factory...Ch. 4 - Job 25AX required 5,000 for direct materials,...Ch. 4 - Job 19AB required 10,000 for direct materials,...Ch. 4 - Match each of the following cost pools with the...Ch. 4 - The books of Petry Products Co. revealed that the...Ch. 4 - The general ledger of Lawson Lumber Co. contains...Ch. 4 - Nelson Fabrication Inc. had a remaining credit...Ch. 4 - Housley Paints Co. had a remaining debit balance...Ch. 4 - The cost behavior patterns below are lettered A...Ch. 4 - Miller Minerals Co. manufactures a product that...Ch. 4 - Scattergraph method Using the data in P4-2 and a...Ch. 4 - Using the data in P4-2 and Microsoft Excel: 1....Ch. 4 - Listed below are the budgeted factory overhead...Ch. 4 - Menlo Materials is divided into five departments,...Ch. 4 - Distribution of service department costs to...Ch. 4 - Journalizing the distribution of service...Ch. 4 - Channel Products Inc. uses the job order cost...Ch. 4 - Determining job costcalculation of predetermined...Ch. 4 - Focus Fabrication Co. uses ABC. The factory...Ch. 4 - Mansfield Manufacturing Co. uses ABC. The factory...Ch. 4 - Hughes Products Inc. uses a job order cost system....Ch. 4 - Abbey Products Company is studying the results of...Ch. 4 - The following information, taken from the books of...Ch. 4 - Rockford Company has four departmental accounts:...Ch. 4 - Luna Manufacturing Inc. completed Job 2525 on May...Ch. 4 - Phillips Products, Inc. had a remaining credit...Ch. 4 - Nathan Industries had a remaining debit balance of...Ch. 4 - Chrome Solutions Company manufactures special...Ch. 4 - Activity-based Costing

Video Options Ltd....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardVargas, Inc., produces industrial machinery. Vargas has a machining department and a group of direct laborers called machinists. Each machinist is paid 25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargass accounting and production history reveal the following relationships between units produced and the costs of direct labor and supervision (measured on an annual basis): Required: 1. Prepare two graphs: one that illustrates the relationship between direct labor cost and units produced, and one that illustrates the relationship between the cost of supervision and units produced. Let cost be the vertical axis and units produced the horizontal axis. 2. How would you classify each cost? Why? 3. Suppose that the normal range of activity is between 2,400 and 2,450 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 400 units. How much will the cost of direct labor increase (and how will this increase be realized)? Cost of supervision?arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forward

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardThayne Company has 30 clerks that work in its Accounts Payable Department. A study revealed the following activities and the relative time demanded by each activity: Required: Classify the four activities as value-added or non-value-added, and calculate the clerical cost of each activity. For non-value-added activities, indicate why they are non-value-added.arrow_forwardMinor Co. has a job order cost system and applies overhead based on departmental rates. Service Department 1 has total budgeted costs of 168,000 for next year. Service Department 2 has total budgeted costs of 280,000 for next year. Minor allocates service department costs solely to the producing departments. Service Department 1 cost is allocated to producing departments on the basis of machine hours. Service Department 2 cost is allocated to producing departments on the basis of direct labor hours. Producing Department 1 has budgeted 8,000 machine hours and 12,000 direct labor hours. Producing Department 2 has budgeted 2,000 machine hours and 12,000 direct labor hours. What is the total cost allocation from the two service departments to Producing Department 1? a. 173,600 b. 140,000 c. 134,400 d. 274,400arrow_forward

- Lansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forwardGeneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forward

- Pelder Products Company manufactures two types of engineering diagnostic equipment used in construction. The two products are based upon different technologies, X-ray and ultrasound, but are manufactured in the same factory. Pelder has computed the manufacturing cost of the X-ray and ultrasound products by adding together direct materials, direct labor, and overhead cost applied based on the number of direct labor hours. The factory has three overhead departments that support the single production line that makes both products. Budgeted overhead spending for the departments is as follows: Pelders budgeted manufacturing activities and costs for the period are as follows: The budgeted cost to manufacture one ultrasound machine using the activity-based costing method is: a. 225. b. 264. c. 293. d. 305.arrow_forwardUniversity Printers has two service departments (Maintenance and Personnel) and two operating departments (Printing and Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and personnel costs on the basis of labor-hours worked by the employees in each. The following data appear in the company records for the current period: Required: Use the direct method to allocate these service department costs to the operating departments. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.)arrow_forwardHensel Manufacturing separates its manufacturing overhead costs into 2 broad categories: (1) maintenance costs and (2) utility costs. Maintenance costs average $100,000 per month, whereas utility costs average $8,000 per month. Maintenance costs are allocated to 2 activity cost pools: (1) the repair cost pool and (2) the set-up cost pool. Utility costs also are allocated to 2 activity cost pools: (1) the heating and air conditioning cost pool (HVAC) and (2) the machinery cost pool. Maintenance costs are allocated to their unique activity cost pools on the basis of the number of employees associated with each pool. Utility costs are allocated to their unique activity cost pools on the basis of kilowatt-hour (kWh) consumption. Of the company's maintenance employees, 70% engage primarily in repair activities, whereas 30% engage primarily in set-up activities. Approximately 75% of the company's kWh consumption can be traced to HVAC use, whereas 25% of its kWh consumption can be traced to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY