Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 21E

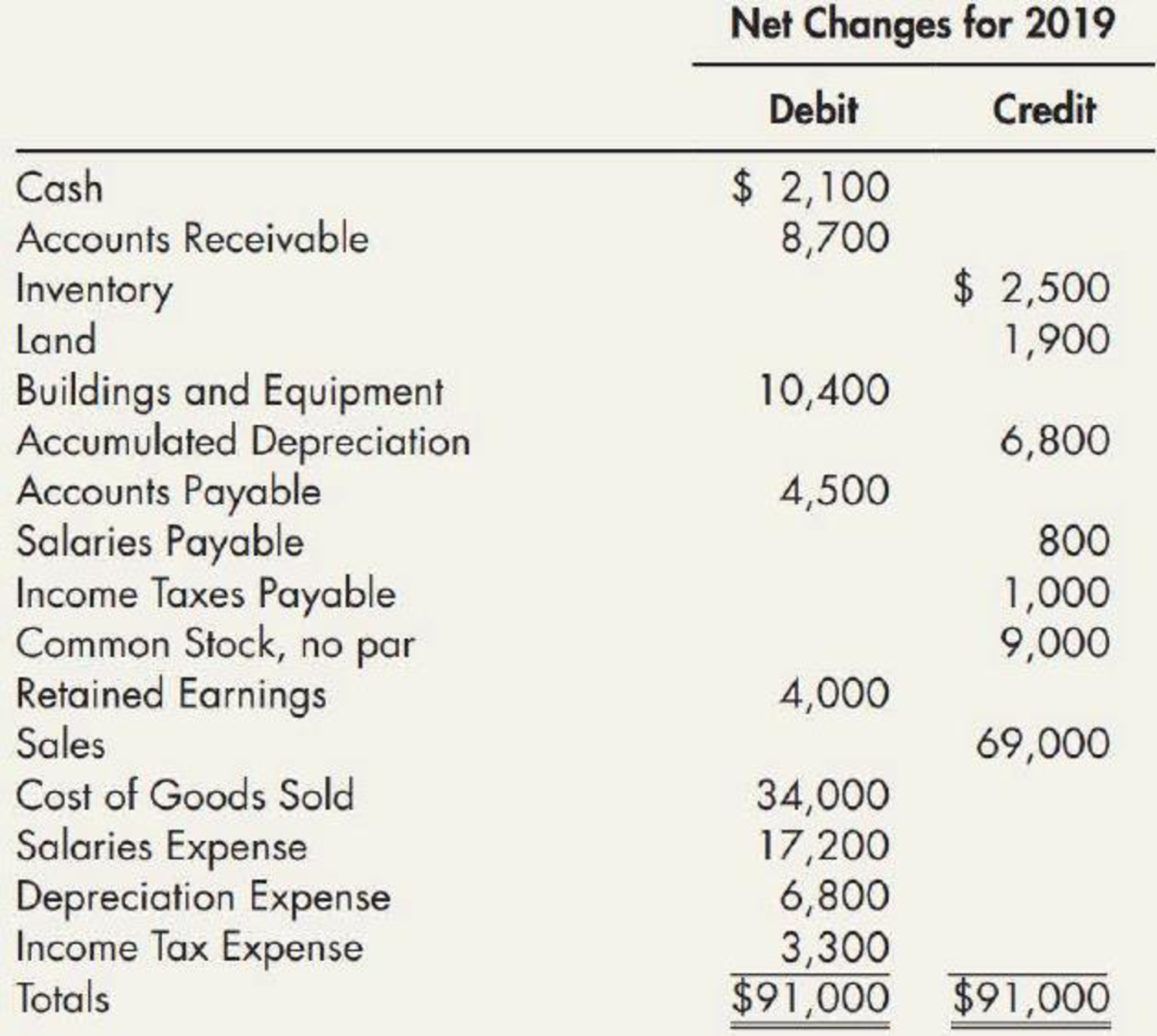

(Appendix 21.1) Visual Inspection The following changes in account balances were taken from Walson Company’s adjusted

In addition, the following information was obtained from the company’s records:

- Land was sold, at cost, for $1,900.

- Dividends of $4,000 were declared and paid.

- Equipment was purchased for $10,400.

- Common stock was issued for $9,000.

- Beginning cash balance was $17,000.

Required:

Using visual inspection and the direct method, prepare Walson’s 2019 statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following is a portion of the current assets section of the balance sheets of Avanti's, Inc., at December 31, 2020 and 2019:

12/31/20

12/31/19

Accounts receivable, less allowance for baddebts of $9,750 and $15,336, respectively

$179,866

$225,851

Required:a. If $11,849 of accounts receivable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint: Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.)

b. The December 31, 2020, Allowance account balance includes $3,034 for a past due account that is not likely to be collected. This account has not been written off.(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020?

Yes

No

(2) If it had been written off, will there be any effect of the write-off on net income and ROI for the year ended December 31, 2020?

Yes

No

c. The…

The following is a portion of the current assets section of the balance sheets of Avanti's, Inc., at December 31, 2020 and 2019:

12/31/20 12/31/19

$173,630

$221,317

Accounts receivable, less allowance for bad

debts of $9,344 and $16,814, respectively

Required:

a. If $11,033 of accounts receivable were written off during 2020, what was the amount of bad debts expense recognized for the year?

Hint. Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.)

Bad debt expense

b. The December 31, 2020, Allowance account balance includes $3,045 for a past due account that is not likely to be collected. This

account has not been written off.

(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020?

O Yes

O No

(2) If It had been written off, will there be any effect of the write-off on net Income and ROI for the year ended December 31, 2020?

O Yes

O No

c. The level of Avanti's…

You have been engaged in your second annual examination of the financial

statements of S Co. The following data were provided to you by the company

accountant:

Cash Receipts:

Collection on sale on account

Cash sales

740,000

100,000

Proceeds of a note payable dated October 1, 2019

and due October 1, 2021, discounted at 18%

30,000

Cash Disbursements:

400,000

Purchase of land and building on April 1, 2019

Full payment of furniture and fixtures purchased

on July 1, 2019

On accounts payable and administrative expenses

Selling expenses

To 518,000

200,000

Of the sales on account, P10,000 was returned because of poor quality and

there was a purchase return of P8,000.

The following data are also available:

December 31, 2018

Accounts Receivable

Merchandise inventory

Accounts payable

Accrued rent expenses

December 31, 2019

200,000

220,000

180,000

40,000

150,000

190,000

230,000

40,000

Of the total purchase price of the Land and Building, 40% is allocated to the

land. Annual depreciation is 5% on…

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 21 - What information does the statement of cash flows...Ch. 21 - Briefly describe the three types of activities a...Ch. 21 - Thompson Company sold a piece of equipment that...Ch. 21 - Give two examples of a companys (a) cash inflows...Ch. 21 - Prob. 5GICh. 21 - Prob. 6GICh. 21 - Prob. 7GICh. 21 - Prob. 8GICh. 21 - Prob. 9GICh. 21 - List the three operating cash inflows that a...

Ch. 21 - Prob. 11GICh. 21 - Prob. 12GICh. 21 - Prob. 13GICh. 21 - Dunn Company recognized a 5,000 unrealized holding...Ch. 21 - Jordan Company recognized a 5,000 unrealized...Ch. 21 - Indicate how a company computes the amount of...Ch. 21 - Prob. 17GICh. 21 - Prob. 18GICh. 21 - Prob. 19GICh. 21 - Which of the following would be considered a cash...Ch. 21 - In a statement of cash flows (indirect method),...Ch. 21 - The net cash provided by operating activities in...Ch. 21 - The retirement of long-term debt by the issuance...Ch. 21 - Prob. 5MCCh. 21 - Selected information from Brook Corporations...Ch. 21 - Prob. 7MCCh. 21 - Prob. 8MCCh. 21 - Which of the following need not be disclosed in a...Ch. 21 - The following information was taken from Oregon...Ch. 21 - Prob. 1RECh. 21 - Prob. 2RECh. 21 - Given the following information, convert Cardinal...Ch. 21 - Given the following information, convert Robin...Ch. 21 - In the current year, Harrisburg Corporation had...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Trenton Corporation has the following items....Ch. 21 - Prob. 9RECh. 21 - In the current year, Harrisburg Corporation...Ch. 21 - Providence Company sold equipment for 25,000 cash....Ch. 21 - Annapolis Corporation paid 270,000 to retire bonds...Ch. 21 - Given the following information, compute Lemon...Ch. 21 - Prob. 14RECh. 21 - Prob. 1ECh. 21 - Prob. 2ECh. 21 - Visual Inspection Noble Companys accounting...Ch. 21 - Prob. 4ECh. 21 - Prob. 5ECh. 21 - Prob. 6ECh. 21 - Prob. 7ECh. 21 - Prob. 8ECh. 21 - Partially Completed Spreadsheet Hanks Company has...Ch. 21 - Spreadsheet The following 2019 information is...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - Fixed Asset Transactions The following is an...Ch. 21 - Retirement of Debt Moore Company is preparing its...Ch. 21 - Interest and Income Taxes Staggs Company has...Ch. 21 - Investments On October 4, 2019, Collins Company...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Investing Activities and Depreciable Assets...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - (Appendix 21.1) Operating Cash Flows The following...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - (Appendix 21.1) Visual Inspection The following...Ch. 21 - Prob. 22ECh. 21 - Classification of Cash Flows A company's statement...Ch. 21 - Prob. 2PCh. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Partially Completed Spreadsheet The following...Ch. 21 - Spreadsheet and Statement of Cash Flows The...Ch. 21 - Prob. 7PCh. 21 - Spreadsheet from Trial Balance Heinz Companys post...Ch. 21 - Prepare Ending Balance Sheet On December 31, 2019,...Ch. 21 - Infrequent Transactions The following transactions...Ch. 21 - Prob. 11PCh. 21 - Comprehensive Angel Company has prepared its...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Operating Cash Flows Refer to the...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Comprehensive The following are...Ch. 21 - Prob. 18PCh. 21 - Financial Statement Interrelationships Prepare an...Ch. 21 - Statement of Cash Flows A friend of yours is...Ch. 21 - Prob. 3CCh. 21 - Operating, Investing, and Financing Activities The...Ch. 21 - Prob. 5CCh. 21 - Spreadsheet Method The spreadsheet method is...Ch. 21 - Prob. 7CCh. 21 - Inflows and Outflows Alfred Engineering Company is...Ch. 21 - Ethics and Cash Flows You are the accountant for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following is a portion of the current asset section of the balance sheets of HiROE Co., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for uncollectibleaccounts of $23,000 and $11,000, respectively $457,000 $359,000 e-2. What factors might have caused the change in this ratio? Check All That Apply Credit was extended to proportionately more slow-paying or high credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or high credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or high credit-risk customers during 2019. Credit was extended to proportionately more slow-paying or high credit-risk customers during 2019. Credit was extended…arrow_forwardThe following accounts were included in the unadjusted trial balance of Editah Company as of December 31, 2019:Cash 963,200Accounts receivable 2,254,000Inventory 6,050,000Accounts payable 4,201,000Accrued expenses 431,000 During your audit, you noted that Editah Company held its cash books open after year-end. In addition, your audit revealed the following:1. Receipts for January 2020 of P654,600 were recorded in the December 2019 cash receipts book. The receipts of P360,100 represent cash sales, and P294,500 represent collections from customers, net of 5% cash discounts.2. Accounts payable of P372,400 was paid in January 2020. The payments, on which discounts of P12,400 were taken, were included in the December 2019 check register.3. Merchandise inventory is valued at P6,050,000 before any adjustments. The following information has been found relating to certain inventory transactions:a. The invoice for goods costing P175,000 was received and recorded as a purchase on December 31,…arrow_forwardCurrent Assets Dorothy Corporation had the following accounts in its year-end adjusted trial balance: Inventories, $23,000; Accounts Receivable, $7,500; Accounts Payable, $7,200; Prepaid Rent, $2,400; Marketable Securities, $3,000; Allowance for Doubtful Accounts, $1,100; and Cash, $1,800. Prepare the current assets section of Dorothy's year-end balance sheet. Current Assets Cash Marketable securities Accounts receivable Less: Allowance for doubtful accounts Inventories Prepaid rent Dorothy Corporation Partial Balance Sheet Total current assets 000arrow_forward

- Current Assets Dorothy Corporation had the following accounts in its year-end adjusted trial balance: Inventories, $23,800; Accounts Receivable, $7,000; Accounts Payable, $7,200; Prepaid Rent, $2,400; Marketable Securities, $3,000; Allowance for Doubtful Accounts, $1,100; and Cash, $1,200. Prepare the current assets section of Dorothy's year-end balance sheet. Current Assets Cash Marketable securities Accounts receivable Less: Allowance for doubtful accounts Inventories Prepaid rent Total current assets Dorothy Corporation Partial Balance Sheet Feedback 7,000 ✓ 1,100✔ 1,200 3,000 ✓ 5,900 23,800 2,400 ✓arrow_forwardRequired Information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks includes the following sccount balances: Accounts Debit Credit $ 27,100 Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Equipnent Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, 2822) 5e, 200 $ 6,200 22, B00 66, 800 25, e00 3,5ee 30,5ee 70, e00 55,e00 25,100 Common Stock Retained Earnings Totals $190,300 $198,300 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $12,e0e. The cards are redeenable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $167,88e. January 15 Firework sales for the first half of the month total $155,e0e. All of these sales are on account. The cost of the units sold is $83,88e. January 23 Receive $127,480 from custoners on accounts receivable. January 25 Pay $11e,eee to…arrow_forwardBayley Company has the following trial balance below at December 31, 2020. All accounts have normal balances. Account Balance Cash $460,000 Accounts receivable (net of the Allowance for Doubtful Accounts) 352,000 Inventory at the lower of FIFO cost and net realizable value 451,000 Trading Investments 230,000 Buildings (net of accumulated depreciation) 740,000 Equipment (net of accumulated depreciation) 240,000 Land held for Future Use 305,000 Goodwill 89,000 Notes Receivable (due 2025) 91,000 Prepaid Insurance 16,000 Accounts Payable 345,000 Guaranteed Investment Certificates 50,000 Notes Payable (due in 2021) 235,000 Bonds Payable at net carrying value (due February 1, 2021) 83,000 Rent Payable 55,000 Bonds Payable at net carrying value (due December 31, 2028) 746,000 Common shares, unlimited number of shares authorized 400,000 Contributed surplus 190,000 Retained…arrow_forward

- Prepare journal entries to record the following transactions. You are required to show all calculations: 3.1 The company adopted the straight-line depreciation method. Record the 15% depreciation on the plant and equipment purchased On 1 December 2020 for R125 000. 3.2 The allowance for credit losses account has an opening balance of R4 500. The policy requires the allowance to equate 8% of the total accounts receivable. The debtors sub-ledger totaled R52 000 prior receiving 40c in the rand on an account of R3 000. The financial manager instructed the write off on the balance.arrow_forward9999...last recheck You have completed the field work in connection with your audit of Carla Corporation for the year ended December 31, 2020. The balance sheet accounts at the beginning and end of the year are shown below. Dec. 31,2020 Dec. 31,2019 Increase or(Decrease) Cash $311,248 $333,760 ($22,512 ) Accounts receivable 525,755 395,360 130,395 Inventory 830,704 683,200 147,504 Prepaid expenses 13,440 8,960 4,480 Investment in subsidiary 123,760 0 123,760 Cash surrender value of life insurance 2,580 2,016 564 Machinery 231,840 212,800 19,040 Buildings 599,424 456,848 142,576 Land 58,800 58,800 0 Patents 77,280 71,680 5,600 Copyrights 44,800 56,000 (11,200 ) Bond discount and issue cost 5,042 0 5,042 $2,824,673 $2,279,424 $545,249…arrow_forwardThe unadjusted trial balance of ABC Company on December 31, 2019, end of its first year of operation, showed among others: Accounts Receivable, P1,250,000 and Cash Sales, P4,560,000. Among its transactions for the year 2020 are the following: a. Sales on account, P5,500,000 b Total collections during the year, P3,500,000 c. The management adopted a policy of providing for doubtful accounts based on 5% of the outstanding receivable at the end of the year. What is the adjusting journal entry on December 31, 2020 in recognizing bad debt expense? Select the correct response: Dr. Bad Debt Expense 62,500; Cr. Allowance for Bad Debts 62,500 Dr. Bad Debt Expense 100,000; Cr. Allowance for Bad Debts 100,000 Dr. Bad Debt Expense 275,000; Cr. Allowance for Bad Debts 275,000 Dr. Bad Debt Expense 162,500; Cr. Allowance for Bad Debts 162,500arrow_forward

- On December 31, 2019, Stevens Company's bookkeeper prepared the following balance sheet with items erroneously classified. Stevens Company Balance SheetFor Year Ended December 31, 2019 Current Assets: Current Liabilities: Inventory $ 6,000 Accounts payable $ 9,900 Accounts receivable 5,900 Allowance for doubtful accounts 800 Cash 2,300 Salaries payable 1,500 Treasury stock (at cost) 3,300 Taxes payable 2,500 Long-Term Investments: Long-Term Liabilities: Temporary investments in marketable securities 3,200 Bonds payable (due 2023) 11,000 Investment in held-to-maturity bonds 10,000 Unearned rent (for 3 months) 900 Property, Plant, and Equipment: Shareholders' Equity: Land 8,100 Retained earnings 24,200 Office supplies 800 Accumulated depreciation on buildings and equipment 9,200 Buildings and equipment 35,600 Additional paid-in capital on common stock 10,400 Intangibles:…arrow_forwardA company's accounts payable dated December 31, 2021, totaled P1.000,000 before any necessary year end adjustments relating to the following transactions and information: • On December 27, 2021. the company wrote and issued checks to creditors totaling P350.000. The issuance of the checks was recorded on January 3, 2022. • On December 28. 2021, the company purchased and received goods for P150.000, terms 2/10. n/30. The company records purchases and accounts payable at net amounts. The invoice was recorded and paid on January 3. 2022 • Goods shipped FOB Destination on December 20, 2021. from a vendor to the company were received on January 2. 2022. The invoice cost was P65,000. The purchase was recorded on January 2, 2022. • Goods costing P120.000 were purchased from supplier with terms FOB shipping point on December 28, 2021. The company received the goods and the invoice on January 4, 2022. • The P1.000,000 ledger balance of accounts payable is net of P80.000 debit balance in one…arrow_forwardA portion of the current assets section of the December 31, 2019, balance sheet for Gibbs Co. is presented here: Accounts receivable $ 23,700 Less: Allowance for bad debts (3,500 ) $ 20,200 The company’s accounting records revealed the following information for the year ended December 31, 2020: Sales (all on account) $ 154,500 Cash collections from customers 147,000 Accounts written off 2,900 Bad debts expense (accrued at 12/31/20) 5,800 Required:Calculate the net realizable value of accounts receivable at December 31, 2020, and prepare the appropriate balance sheet presentation for Gibbs Co. as of that point in time. (Hint: Use T-accounts to analyze the Accounts Receivable and Allowance for Bad Debts accounts.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License